Savings account with daily compound interest

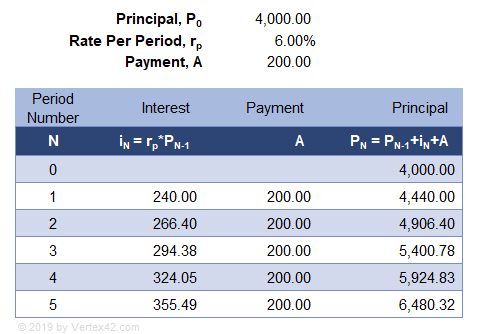

Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. Heres the savings account equation.

Compound Interest Calculator For Excel

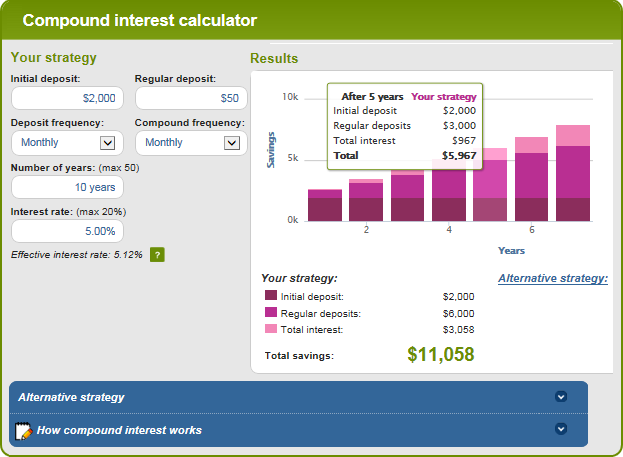

Opting for a savings account that earns interest such as high-yield savings accounts money market accounts and CDs is one way to make compound interest work in your favor.

. The money in your account benefits from compound interest that is calculated daily and paid monthly. BOQs high interest savings account lets you enjoy bonus interest each month when you meet the criteria. How often you compound determines how quickly your deposit grows with more compounding periods resulting in greater interest accrued.

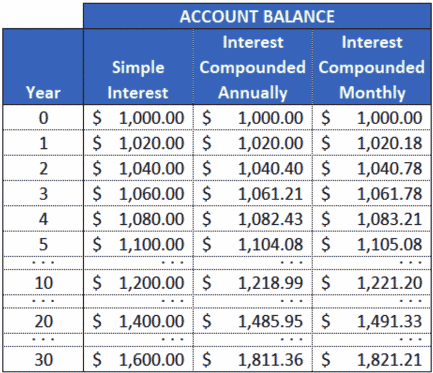

Know the formula for calculating the effect of compound interest. Interest paid in year 1 would be 60 1000 multiplied by 6 60. The more often interest compounds the faster your balance will grow.

How can I tell if a savings account pays compound interest. As a result the money in the savings account would earn compound interest. For customers aged 36 years and over.

Depending on your financial institution and the account interest can compound daily monthly quarterly or annually. Even small deposits to a. This amounts to a daily interest rate of.

APY annual percentage yield. This is a very high-risk way of investing as you can also end up paying compound interest from your account depending on the direction of the trade. The Interest Savings Account earns an industry-leading 253 APY with no minimum deposit or monthly fees.

Capital One compounds interest daily and credits it to your account monthly. Today it offers two savings accountsits high-yield Interest Savings Account and its Mileage Savings Account. To begin your calculation take your daily interest.

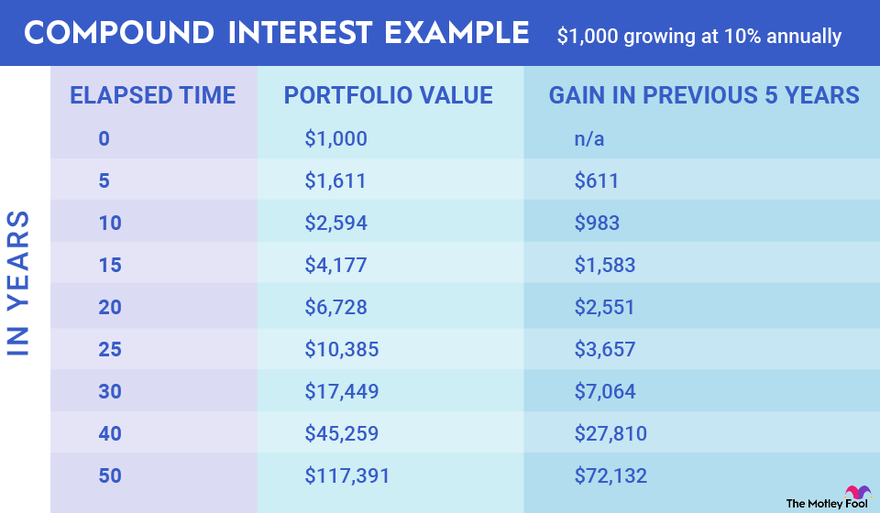

Thought to have. Opening a high-interest savings account has several benefits as elaborated below. Compound interest allows you to earn interest on your interest helping your money grow quicker.

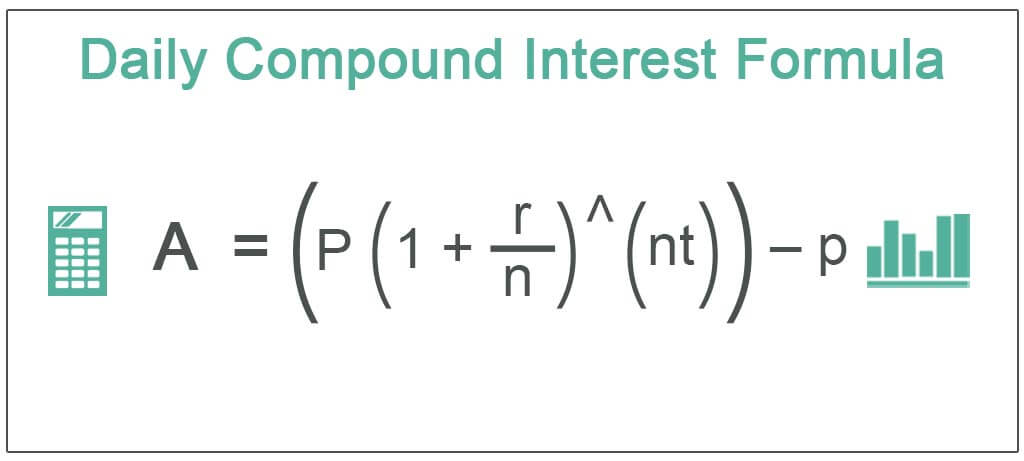

P is the principal P r is the annual rate of interest and n is the number of times the interest is compounded per year. This means that the amount of interest you earn. Daily closing balance x interest rate as a percentage 365.

Treasury savings bonds pay out interest each year based on their interest rate and current value. Round up your transactions. The Mileage Savings Account presents a unique opportunity to earn airline miles simply by saving.

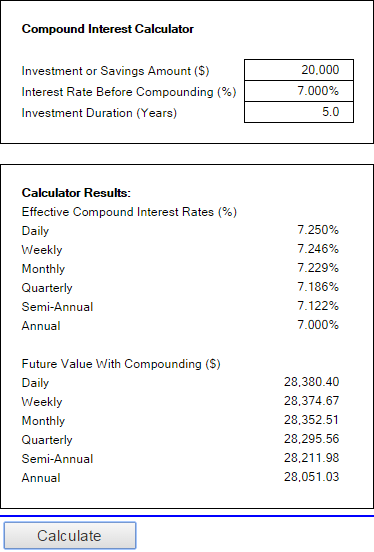

Suppose your account has earned 10 in interest. Your effective annual interest rate including compounding interest dictates how much you will effectively earn on a savings account over one year. How to calculate daily compound interest.

Assume that the 1000 in the savings account in the previous example includes a rate of 6 interest compounded daily. How does Capital One compound interest. Using the formula above depositors can apply that daily interest rate to calculate the following total account value after two years.

After a year youve earned 100 in interest bringing your balance up to 2100. At the same time most banks and other regulated financial institutions that hold an Australian. Calculate interest compounding annually for year one.

For example lets say you deposit 2000 into your savings account and your bank gives you 5 percent interest annually. A t 365 2 A t. A compound interest savings account can help you grow your money over time whether youre working with a large or small balance.

Daily compound interest is calculated using a simplified version of the formula for compound interest. This means that each day you earn interest on your principal balance plus. Link up to 9 eligible transaction accounts.

Interest is compounded daily. The formula for calculating compound interest accumulation on a given account balance is. If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings.

At Ally Bank we compound interest daily giving your savings an advantage over deposit accounts that compound interest just quarterly or annually. Low risk low cost. The 1 interest rate compounded daily for 10 years has added more than 10 to the value of your investment.

For instance SFGI Direct Savings account earns 121. If you leave that extra bit of money in your account it will also start earning interest during each compounding period many online savings. You can compare and choose a high-interest savings account that doesnt charge high account fees and thereby preserve more of your savings.

Compound Interest Calculator Savings Account Interest Calculator Consistent investing over a long period of time can be an effective strategy to accumulate wealth. Assume that you own a 1000 6 savings bond issued by the US Treasury. Most savings accounts calculate and compound interest daily.

Capital Ones savings account interest rates arent the absolute highest available today.

Compound Interest Calculator For Excel

Compound Interest Calculator With Formula

Compound Interest Formula And Calculator For Excel

Compare Compound Interest Accounts Savings And More Finder Com

What Is Compound Interest Becu

Simple Vs Compound Interest Definitions And Calculators Quicken

Compounding Interest Formulas Calculations Examples Video Lesson Transcript Study Com

Daily Compound Interest Formula Step By Step Examples Calculation

What Is Compound Interest And How Does It Work For Your Savings Ally

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Compound Interest Formula And Calculator For Excel

What Is Compound Interest Becu

Accounts That Earn Compounding Interest

Compound Interest Definition Formula How It S Calculated

What Is Compound Interest And How Does It Work For Your Savings Ally

Personal Finance 101 Compound Interest Savings Accounts Synchrony Bank

:max_bytes(150000):strip_icc():gifv()/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)

Compound Interest Explained With Calculations And Examples